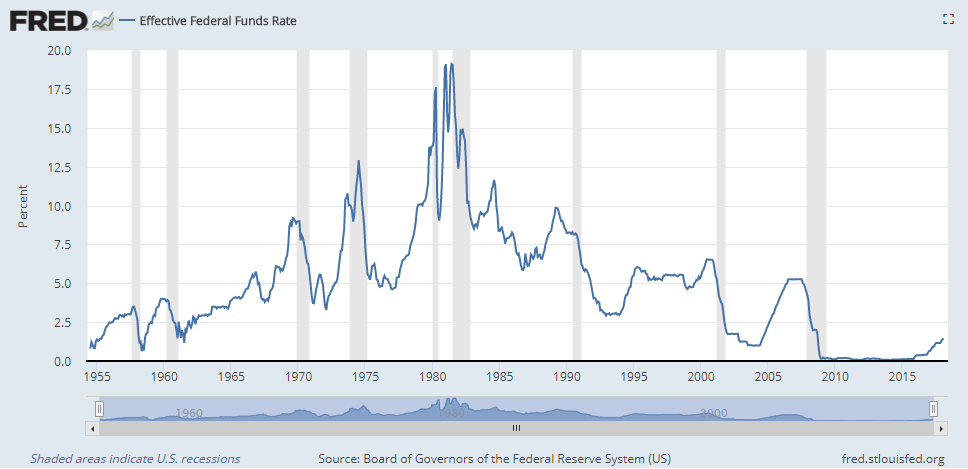

Read MoreYou may have heard an age-old mythology phrased "Don't fight the Fed," which is meant to prompt you to sell stocks when the Fed raises the short rate. Nonsense - on average, stocks have done perfectly fine when the Fed raised the short rate - although not always.

Python for Finance: 2018 CFA L2 Quant SS3 Reading 9 Part 2 - Regression

Welcome to Part 2 of my adventures with a Pythonic CFA Level 2 quant study guide. Part 1 covered correlation analysis; Part 2 will start off with Learning Outcome Statement 9d and go from there. If the embedded iframe doesn't work, you can find the code on Kyso: https://beta.kyso.io/matter/2018cfal2ss3r9part2

I got most of the way through this reading, but had to move on to other (less python friendly) readings; I'll try to revisit this series after the exam.

Python for Finance: 2018 CFA L2 Quant SS3 Reading 9 Part 1 - Correlation

This year I'm trying to take the 'bite' out of computational finance a bit by using Python to better understand the relationships and formulas in the CFA 2018 L2 text. Here's the first installment, focusing on correlation. I'm using new service kyso.io to host my Jupyter notebooks, and so far it seems to be working well! Gladly welcome comments on this work.

If you want to download my jupyter notebook to edit yourself, you can do so here.

If the embed doesn't work, you can view the notebook here: https://kyso.io/matter/2018cfal2ss3r9part1/embed?code=output